Free Download: Comparing Plans Spreadsheet

Perhaps you started a new job with health benefits, it’s time to renew your coverage during an open enrollment period, or maybe you are self-employed and looking on the marketplace for coverage for yourself and your family. If you have employer-sponsored coverage or are shopping for health insurance on the Marketplace, the options can feel confusing or overwhelming. How do you figure out which plan will best meet your needs? Let’s look at how to compare different plans.

Health care coverage is really complicated. It can help to start by figuring out what your needs and options are. So, here are some questions to keep in mind:

What types of coverage are available to me?

Is the plan a Health Maintenance Organization (HMO), a Preferred Provider Organization (PPO), or another type of coverage? HMO plans are usually less expensive than PPO plans but allow you fewer choices in providers of care

Does the plan qualify for a Health Savings Account (HSA)?

Does your employer offer Flexible Spending Accounts (FSA), or a Health Reimbursement Account (HRA)?

Who in my household needs to be insured?

What are my health care needs and those of the people in my household? Do my household members, or I have any chronic health conditions or prescriptions that will affect my annual health care costs? Am I having any medical or mental health symptoms for which I need, or may need, evaluation and possible treatment?

Will I need care outside the area where I live?

Understanding the needs of yourself and your household is the first step towards choosing an appropriate health insurance plan.

Odds are, if you are getting health insurance through your employer, all the plans offered to you will be from the same carrier, such as Anthem or United. Particularly if it’s a large employer, the employer may be self-insured and only using the health insurance company to administer the plans. (Pause) If you are looking at coverage on the Marketplace, there will likely be several different insurance companies to choose from. What are their reputations in your community? Do people you know have experience with their provider networks and customer service, or do you know how promptly they pay claims? You can also do an internet search to see what you can learn. If you learn that Carrier A has long hold times and few participating doctors or hospitals in your area, you may not want to put their plans at the top of your list.

If you are searching for coverage on Kentucky’s Marketplace, use kynect’s built-in tool to see if you qualify for premium subsidies or cost-sharing reductions. These will affect how much you spend per month and per year. In addition, while premium subsidies can be applied to Bronze, Silver, or Gold tier plans, cost-sharing reductions are only available on Silver tier plans.

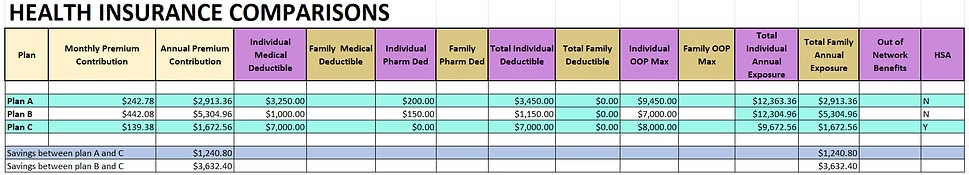

Next, carefully look at the details of the plans being offered. This information may come to you through literature from your employer or through the Marketplace website and links provided under the plan options. It can be very helpful to plug the data into a spreadsheet so that you can see benefits and numbers all in one place. We have provided you with a sample spreadsheet – click here to download it.

Start by looking at the premiums and deductibles. Premiums are the amount you pay per month to have an insurance plan. If you are only responsible for a portion of the premium, make a note of the total amount you would need to pay each month for each plan. If the amount is listed as a per paycheck contribution and you are paid every 2 weeks, what you would owe each month would be roughly twice the amount listed as the per paycheck contribution. Deductibles are the annual amount that you pay out of pocket for covered services other than preventive care before your insurance starts paying for your health care.

Next, focus on co-pays and co-insurance. Co-pays are fixed amounts you pay for services like doctor visits or prescriptions. You might reasonably think that the term co-insurance refers to a second type of insurance, but it usually doesn’t. Rather, it indicates a percentage of the allowable that you pay for covered services. The allowable is the amount of payment that your provider has agreed to accept for a given service. For each plan you are considering, check out how much you will be required to pay for specific services and how the costs are shared between you and your insurance. The total cost of all the expenses you might have to pay for covered services within a plan year, not counting your premium, is called your out-of-pocket maximum. Be aware that there may be a separate deductible for prescriptions. Also, most plan years end on December 31, so if you start your insurance on July 15, chances are good that the deductible and out-of-pocket maximum amounts will start over again on January 1.

Then, you will want to check if your preferred medical providers, hospitals, and pharmacies are in the plan’s network. If not, it will cost you more, possibly substantially more, to use them. There are a couple of ways to find out if a particular provider is in network. You can follow the links on the Marketplace or go to the insurance company’s website, where you will enter the provider’s name and see if they are listed as participating providers for the plan you want. Unfortunately, it can be difficult, if not impossible, to see a complete directory of all the plan’s providers. Also, a provider’s participation with a given plan can change at any time. Another option is to call the doctor’s office or the facility of interest and ask if they participate in the plan or plans that you are considering. Be aware that if a plan is an HMO, it will have a narrow or more restricted network, meaning fewer participating providers and a smaller geographic distribution, than a PPO-type plan.

If you regularly take medications, you will want to pay special attention to how different plans handle those costs. Many have a tier system, where you pay less for generic medications compared to brand-name drugs. Plans may also offer cost savings if you purchase a 90-day supply of your prescriptions rather than buying them 30 days at a time. Once you have all these details, you will want a simple chart or list to compare the key features of each plan. We have created a sample spreadsheet for you.

When looking at different plans, you will want to consider both your anticipated health care needs for the coming year and the total amount you are at risk of spending with each plan you are considering. Do you have chronic illnesses that mean you will have frequent doctor visits and take several medications? Do you have joint problems that are close to needing surgery? Do you have hobbies like running marathons that put you at increased risk of injury? While no one can predict the future perfectly, the likely medical costs for someone who is young and healthy are typically less than those who are older and have health issues. And remember, it’s not just about the monthly premium. Be sure to factor in your estimated out-of-pocket costs. This gives you a clearer picture of each plan’s overall value.

Finally, find out if Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs) are available for use with your plan. These programs allow you to put aside tax-free money for qualified medical expenses.

As you can see, there are a host of factors to think about when deciding which health insurance plan to choose. A plan with a low premium, but a high deductible, might work well if you’re generally healthy and don’t visit the doctor often. A plan with higher premiums but lower co-pays and deductibles could be better if you have medical needs requiring a lot of care and follow-up. Or it may be important to you to find a plan that offers greater flexibility in provider choice. This might be necessary if you spend the winter in a state somewhere other than your primary residence or want the freedom to see specialists without having to obtain a referral.

Let’s put this into practice and look at some numbers. Consider the chart below. Which plan might be right for you?

Breaking down these health insurance plans in everyday terms can help you understand what might work best for you.

Plan A: In this first column, you can see that the premium for this plan is $242.78 per month. The next shows the total annual premium ($242.78 x 12 months). Under the Medical Deductible column, you’ll see that you would have to pay $3,250 out of pocket for covered services other than preventive care before the insurance kicks in. For medications, you’ll first need to cover the $200 pharmacy deductible before your insurance pays for those services. The total deductible field represents the combination of the medical and pharmacy deductibles. The out-of-pocket maximum is the most you would be required to spend for covered healthcare costs, not including premium expenses, in a plan year. Once the in-network out-of-pocket maximum is met, your insurance plan must cover 100% of all remaining in-network expenses. Annual exposure is the most you could pay in a year for your covered health care costs. So, the total annual exposure column combines the total annual premium costs with the out-of-pocket maximum for the most you could pay in a year. For this plan, you can see that the total annual exposure under this plan would be $12,363.36. Another point to keep in mind. If you have an HMO, odds are that out of network services will not be covered at all. If you have a PPO or other plan that does offer out of network benefits, the deductibles and out of pocket maximums for the out of network care will invariably be higher.

In addition, we can see that this plan does not offer a Health Savings Account, or HSA. As mentioned earlier, an HSA is a type of savings account offered by an employer, or with some Marketplace plans, that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. Money invested in an HSA lowers a person’s overall health care costs by using untaxed HSA dollars to pay for deductibles, co-payments, co-insurance, medications, and other qualified health care expenses. HSA funds generally may not be used to pay premiums. HSA accounts can be rolled over year to year and remain with the employee, even if they leave their job. They can also earn tax-free interest.

Plan B: The premium costs are greater, at $442.08 per month. However, we can see that the deductibles are lower. You will need to spend $1,000 before your insurance pays for medical costs (except for preventive care), and $150 for pharmacy costs. This makes the total deductible obligations lower. The maximum out-of-pocket expense is capped at $7000. Furthermore, compared to Plan A, if you need a lot of medical services, the total amount that you could have to spend in a year is a little less at $12,305 as opposed to $12,363. Note that this plan also does not include an HSA.

Plan C has the lowest monthly premium at $139.38. However, at $7,000 the deductible is much higher than the previous plans. Plan C does not have a separate pharmacy deductible, so both medical and pharmacy expenses count towards the same deductible. Continuing with our calculations, the out-of-pocket maximum is $8,000, for a total annual exposure of $9,673. This is significantly less than the total potential costs of Plans A and B. Another advantage-Plan C can be paired with an HSA, resulting in further cost savings.

Using our spreadsheet, we can see that Plan C has the lowest total annual exposure, even with the much higher deductible. When Plan C is compared to plan A, the annual premium savings are $1,241, and compared to Plan B, you would save three times as much, at $3,632. When you include the out-of-pocket maximums, the total amount saved with Plan C compared to both Plans A and B is about the same, $2,600. There’s also another important factor to keep in mind: The money you spend on premiums is gone whether you have any medical costs during the year or not. Also, the out-of-pocket costs are theoretical. You may or may not spend this money. Another way to think about it is that for Plan C, the known costs are $3,632 less than for Plan B. Even if you wind up spending the maximum amount, it will still cost you about $2,700 less for the year than Plan A and you can have an HSA!

In summary:

Plan A is between Plan B and Plan C in terms of monthly cost, and the deductible, or the amount you must spend before the insurance carrier starts paying for your care is higher than Plan B and lower than Plan C.

Plan B is the most expensive per month, but it has a lower medical deductible and out of pocket maximum than both plans A and C.

Plan C has the lowest monthly cost but has the highest deductible. Nonetheless, it has the potential to be the least expensive over the duration of the plan year. In addition, it offers the advantage of an HSA

A couple of important points:

Compare plans based on cost alone ONLY if benefits such as the provider networks are the same among plans. Otherwise, you will want to consider the relative advantages and disadvantages of these other factors

If you choose a high deductible plan or one with a high out-of-pocket maximum, it is critical to put aside funds to pay for those costs. If this type of budgeting is a challenge for you, you might be better off with a plan that has a higher premium, but lower costs at the time of service.

Depending on your health needs, budget, and whether you prefer the option to save with an HSA, one of these three plans might be a better fit for you than the others.

You can use our spreadsheet to help calculate which plan would work best for you.

Identify the plans you are considering. Write the name of each plan into the Plan column, for example “Anthem Silver Blue Access Plan 1.”

For the monthly premiums column, fill in the monthly premium cost for the plan. This will auto-populate the Annual Premium field to let you know the total yearly cost in premiums.

Find the medical and pharmacy deductibles for the plan you are looking at. Input those and the sum will appear in the Total Deductible field.

Refer back to the plan information to locate the out-of-pocket maximum.

Once entered into the spreadsheet, you should see your total annual exposure for that particular plan. Note that there are different out-of-pocket maximum columns for an individual and for a family. Use the column appropriate for your situation.

Do this again for each of the plans you are considering, so that you can easily compare and choose the best option. Be sure to consider the added cost-saving benefits if the plan qualifies for an HSA, or if an FSA or Health Reimbursement Account (HRA) is available. Click here to learn more about HSAs, FSAs, and HRAs.

Depending on your situation, the plan with the lowest premium or the lowest deductible may or may not be your best option, once you’ve considered your total potential out-of-pocket expenses. Remember, a little effort and knowledge goes a long way in ensuring that your coverage best meets your medical, emotional, and financial needs.

These materials were supported by funds made available by the Kentucky Department for Public Health’s Office of Population Health from the Centers for Disease Control and Prevention, National Center for STLT Public Health Infrastructure and Workforce, under RFA-OT21-2103.

The contents of these materials are those of the authors and do not necessarily represent the official position of or endorsement by the Kentucky Department for Public Health or the Centers for Disease Control and Prevention.